On 30th

June 2009 when the international credit crunch hit Ireland, the Irish

Nation saw their entire economy collapse with an unworkable National

Debt of €65bn. Three years later the total has doubled to €131.7bn and

continues to increase at €100,000 every three minutes. The average

income in Ireland is around €22,000 (CSO-2010) whilst the National Debt

per person is €27,000 (2012). If every Irish worker gave up a quarter of

their income every year for the next 5 years, the debt could still not

be paid. Austerity, referenda, IMF advice, EU financial guidance and

decisions by the Dáil Éireann will now keep Ireland in debt for the

foreseeable future whilst propagating the very financial monetary system

that caused the global economic crisis in the first place.

Alternatively,

Ireland’s national debt could be parked in a similar fashion to

Argentina in 2001. In a radical shift in economic policy President

Adolfo Rodriguez stated that the Argentine people would take priority

over national debt payments by introducing a parallel currency alongside

the peso to create liquidity. In the same way, the Irish government

could rethink economic policy at a government level but instead of

creating an alternative currency, create a new economy network for

transacting. Ireland could then retain the

trading currency of Europe, whilst rejecting EU debt treaties, stopping

the socialisation of debt through long-term austerity measures imposed

on it's people.

Alternatively,

Ireland’s national debt could be parked in a similar fashion to

Argentina in 2001. In a radical shift in economic policy President

Adolfo Rodriguez stated that the Argentine people would take priority

over national debt payments by introducing a parallel currency alongside

the peso to create liquidity. In the same way, the Irish government

could rethink economic policy at a government level but instead of

creating an alternative currency, create a new economy network for

transacting. Ireland could then retain the

trading currency of Europe, whilst rejecting EU debt treaties, stopping

the socialisation of debt through long-term austerity measures imposed

on it's people.

The

technology now exists to create a transaction network economy from a

peer-to-peer [P2P] citizen architecture that can perform transactions

through online accounts operating from online

mobile payment-processing platforms. This independent solution would remove

transaction costs and allow money to flow freely throughout the

population whilst offering layers for banking, savings and loans.

By implementing an alternative infrastructure, expensive intermediary, financial service providers are circumnavigated to

prevent extractive accounting mechanisms from draining resources

away from communities; enabling a cycle of continuous reinvestment back

into the economy, creating wealth, jobs and infrastructure.

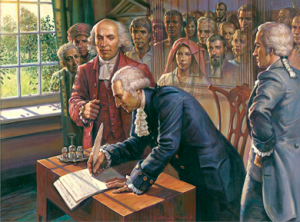

The

Irish state could guarantee this transaction network economy by government

charters for an internetwork of citizen identity accounts. Charters have

long been the traditional way for constitutional governments to

authenticate new institutions, making them acceptable in the public

realm. With the will to create a new social economic system, a

government could begin to promulgate charters that guarantee a new

participatory transaction network, designed upon digital identity for

every citizen be the architect of their own life. From this

citizen-centric approach a new transformational role for government

could emerge as a guarantor of new forms of citizenship and finance.

Economic change through social responsibility is far more affordable

than the existing banking solutions, which have proven socially

irresponsible, institutionally corrupt and negligent.

The

Irish state could guarantee this transaction network economy by government

charters for an internetwork of citizen identity accounts. Charters have

long been the traditional way for constitutional governments to

authenticate new institutions, making them acceptable in the public

realm. With the will to create a new social economic system, a

government could begin to promulgate charters that guarantee a new

participatory transaction network, designed upon digital identity for

every citizen be the architect of their own life. From this

citizen-centric approach a new transformational role for government

could emerge as a guarantor of new forms of citizenship and finance.

Economic change through social responsibility is far more affordable

than the existing banking solutions, which have proven socially

irresponsible, institutionally corrupt and negligent. Despite the ‘Celtic Tiger’ economics unleashed by EU structural

adjustment policies, Ireland now looks more like part of the

marginalised periphery of failing European states caught in a tidal wave

of debt. International debt adjustments treaties are primarily designed

to serve their signatories. What citizens need are social economics

based on localised solutions that serve the national interest. In

Ireland this could be more easily achieved if government charters worked

through an existing social network, such as the Gaelic Athletic

Association (GAA). The GAA has the trust to broker a new form of social

economics because it is rooted in the cultural identity of every local

community. This would allow the Irish government to move out of the

current crisis using a transaction infrastructure based on an existing

citizen network, for a more resilient economic future.

Despite the ‘Celtic Tiger’ economics unleashed by EU structural

adjustment policies, Ireland now looks more like part of the

marginalised periphery of failing European states caught in a tidal wave

of debt. International debt adjustments treaties are primarily designed

to serve their signatories. What citizens need are social economics

based on localised solutions that serve the national interest. In

Ireland this could be more easily achieved if government charters worked

through an existing social network, such as the Gaelic Athletic

Association (GAA). The GAA has the trust to broker a new form of social

economics because it is rooted in the cultural identity of every local

community. This would allow the Irish government to move out of the

current crisis using a transaction infrastructure based on an existing

citizen network, for a more resilient economic future. Published by Oliver Ashton & Fred Garnett

Published by Oliver Ashton & Fred Garnett@oliverashton @fred Garnett

oliver@oliverashton.com

http://transitiontransaction.wordpress.com/

http://digitalcitizennetwork.wordpress.com/

http://www.thundrbank.com/

No comments:

Post a Comment